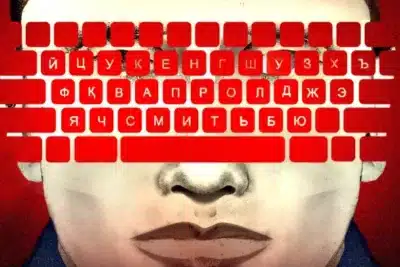

The economy that operates in the shadows: A look at the informal economy in Belarus

In Belarus, a significant portion of the economy operates outside the formal regulatory framework. This hidden world of economic activity is often referred to as the informal economy. Its existence, though largely invisible in official statistics, is crucial to understanding the resilience of Belarusian citizens in navigating economic uncertainty. The economy that operates in the shadows: A look at the informal economy in Belarus offers insight into how individuals sustain themselves, how businesses adapt, and how the state responds to activities that escape formal taxation and oversight.

Informal economies are not unique to Belarus but are prevalent in many transitional and emerging economies. The Belarusian case is particularly interesting because of its combination of state-centered economic policies and widespread informal practices that fill gaps left by official structures.

Definition and Scope of the Informal Economy

The informal economy includes all productive activities that are not regulated by the government. This may include unregistered businesses, street vendors, freelance workers avoiding taxes, and even barter systems. In Belarus, these activities range from small-scale trade in local markets to more complex service provision outside formal channels. The International Labour Organization (ILO) defines the informal economy as encompassing both self-employment and unprotected wage employment, emphasizing that these activities are usually not covered by labor regulations, social protection, or taxation.

Understanding the scope of the informal economy in Belarus is essential because it accounts for a significant share of employment, particularly in urban centers and among younger populations. Some estimates suggest that the informal sector may contribute up to 20-30% of total economic activity, although exact figures are difficult to ascertain due to its hidden nature.

Key Sectors in Belarus' Informal Economy

The informal economy in Belarus spans several sectors:

- Retail and Trade: Street markets and small shops often operate without official registration, selling goods ranging from clothing to electronics.

- Services: Freelancers offering tutoring, IT services, construction, and domestic help frequently operate outside the formal economy.

- Agriculture: Many small farmers sell produce directly to consumers, bypassing official supply chains and regulations.

- Transportation: Unlicensed taxi services and informal logistics providers supplement the formal transportation system.

Each of these sectors demonstrates the adaptability of citizens who respond to economic pressures, regulatory barriers, and limited access to formal employment opportunities. Informal sectors often flourish in niches where official institutions are either inefficient or inaccessible.

Drivers Behind Informal Economic Activities

Several factors contribute to the prevalence of informal economic activity in Belarus:

- Regulatory Complexity: Many businesses avoid registration due to complicated procedures, bureaucratic delays, and high compliance costs.

- Economic Necessity: With limited formal employment opportunities, individuals often rely on informal work to sustain themselves and their families.

- Limited Access to Finance: Entrepreneurs unable to access bank loans or microfinance often resort to informal operations.

- Cultural Factors: There is a historical precedent in Belarus for informal trading and community-based exchange systems, which have persisted across generations.

These drivers highlight that the informal economy is not merely a product of illegality but also a reflection of the resilience and ingenuity of Belarusian citizens.

Government Response and Regulation

The Belarusian government has traditionally maintained strict economic control, including state-owned enterprises and heavy regulation. Attempts to formalize the informal sector have included simplified registration procedures, tax incentives, and awareness campaigns aimed at small entrepreneurs. Nevertheless, enforcement remains inconsistent, creating a dynamic tension between legality and necessity.

International organizations often recommend gradual integration of informal activities into the formal economy rather than punitive measures. Policies that improve access to finance, simplify tax registration, and provide social protection can help formalize the sector without disrupting livelihoods

Challenges and Risks for Workers

Informal workers face a range of challenges, including:

- Legal vulnerability due to unregistered business activities.

- Exposure to unsafe working conditions.

- Lack of access to social security, health insurance, and pensions.

- Limited opportunities for business growth or formal financing.

Despite these risks, the informal economy often provides essential opportunities for those excluded from formal employment. Understanding these dynamics is crucial for policymakers, economists, and social planners.

Future Outlook

The informal economy in Belarus is likely to persist, influenced by economic pressures, global market trends, and domestic policy choices. Technological developments, including digital marketplaces and online payment systems, are reshaping informal economic interactions, making them more efficient and accessible. However, the government’s approach to regulation, taxation, and labor rights will play a critical role in determining whether the sector gradually formalizes or remains largely underground.

Economists suggest that targeted reforms—such as supporting micro-entrepreneurs, simplifying business registration, and expanding social protection—can create a bridge between the informal and formal economy. This would enhance transparency, improve labor conditions, and stabilize economic growth while maintaining the flexibility and resilience that informal work provides.

The economy that operates in the shadows: A look at the informal economy in Belarus reveals a complex interplay of necessity, ingenuity, and regulatory challenges. Informal economic activities sustain livelihoods, fill gaps left by formal institutions, and reflect the adaptability of Belarusian citizens. While it presents challenges for taxation and social protection, understanding this hidden economy is critical for creating policies that balance legality with economic resilience.

By acknowledging the informal economy and integrating it strategically into national development plans, Belarus can harness its potential while mitigating risks, ensuring that the "shadow economy" supports rather than undermines the broader economic and social framework.

Leave a Reply

You must be logged in to post a comment.

Social and Economic Impact

The informal economy has complex social and economic consequences. On one hand, it provides livelihoods for many and contributes to household income, especially in regions where formal jobs are scarce. On the other hand, it poses challenges for tax collection, labor rights, and social security systems.

For workers, informal employment often lacks legal protections, health benefits, and pension contributions. However, it can offer flexibility and immediate income, which is critical in periods of economic instability. From a macroeconomic perspective, the informal economy may reduce government revenue but simultaneously sustains consumer spending and local commerce, acting as an invisible buffer for the broader economy.